The UK’s Economic Growth Problem: Planning System History of Labour party failure to correct the economy’s flow

Source: The New Yorker

The planning system in the United Kingdom plays a crucial role in shaping economic development by regulating land use, housing construction, and infrastructure investment. While intended to balance growth with environmental and social concerns, the system has increasingly been criticised for creating rigid supply constraints. These constraints have contributed to persistent housing shortages, rising prices, and limited expansion of productive capacity. From an economic perspective, restrictive planning regulations can weaken the supply side of the economy, reducing potential output and long-term growth. This article briefly examines the UK planning system as a key institutional factor influencing economic performance.

A blockage to the economy’s growth

The UK planning system significantly shapes long-term economic performance by governing housing supply, infrastructure, and productivity growth. Originally intended to balance development with environmental and community needs, it is now often criticised for creating rigid supply constraints that hinder economic responsiveness.

Persistent shortages in housing, transport, and industrial space have occurred alongside sustained population growth. Many economists attribute these shortages not to demand, but to institutional barriers within planning—lengthy approvals, discretionary decisions, and strong local veto powers. These have slowed construction and inflated prices, especially in high-productivity regions like London and the Southeast.

Macroeconomically, such constraints act as a negative supply-side shock. By limiting physical capital expansion and labour mobility, planning may reduce potential output, raise structural inflationary pressures, and weaken long-run growth.

This article analyses the UK planning system through an economic lens, exploring how its regulations affect supply conditions, investment, and growth. By connecting institutional features to macroeconomic outcomes, it assesses whether planning reform could improve UK economic performance.

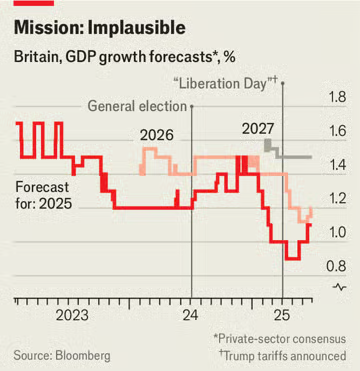

Figure 1: Britain GDP growth Forecast,%

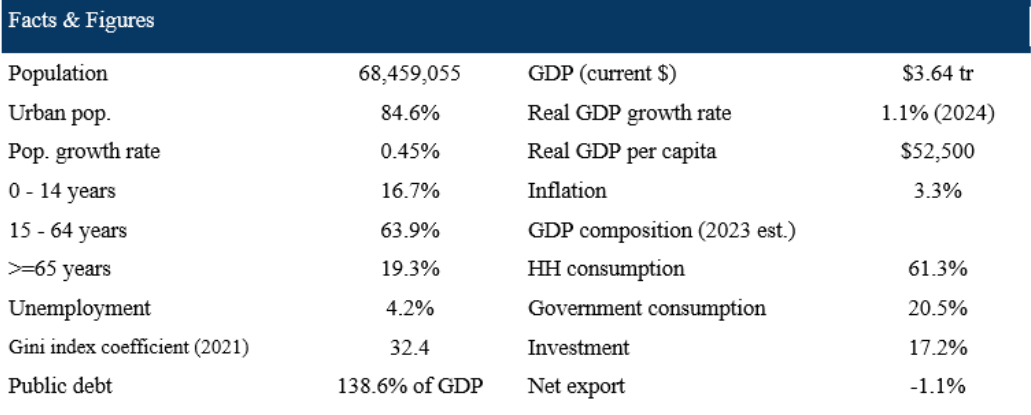

Table 1. United Kingdom Statistics

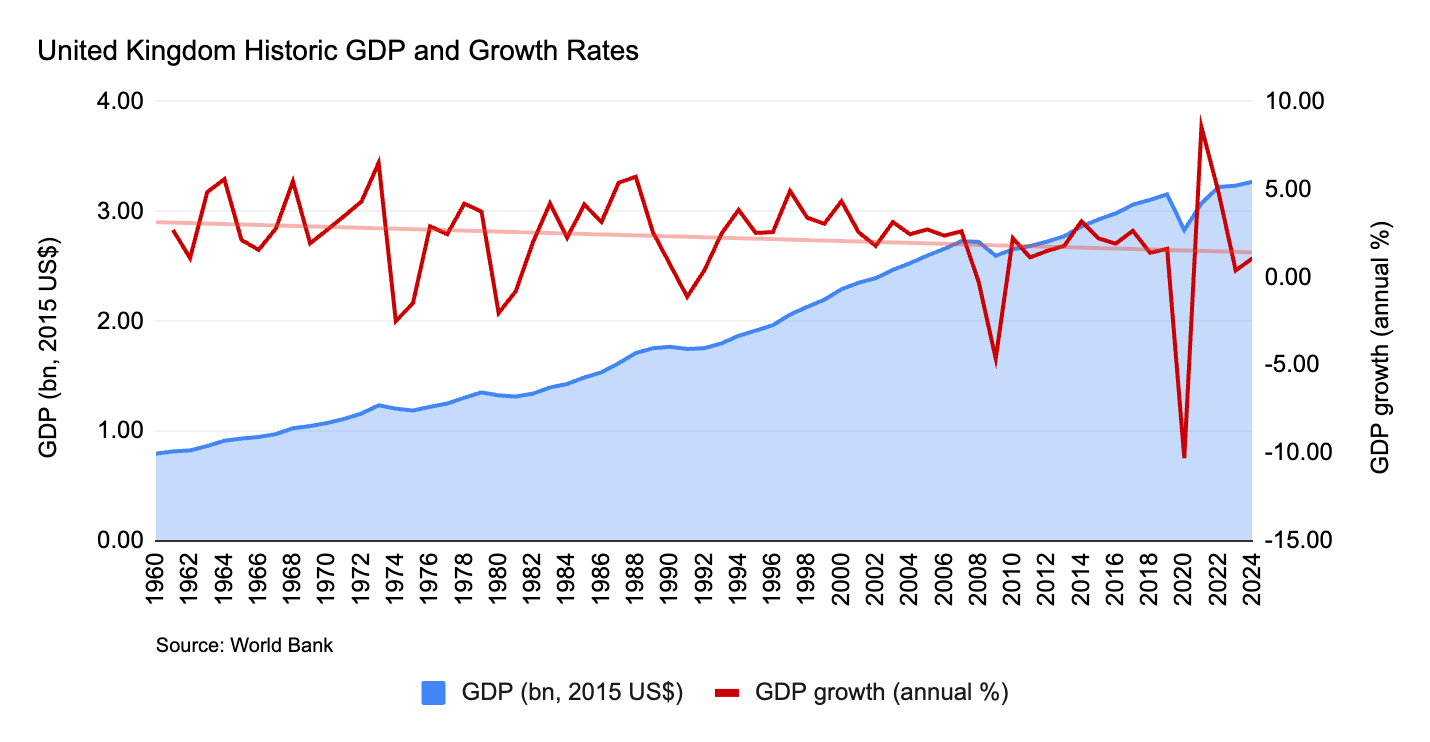

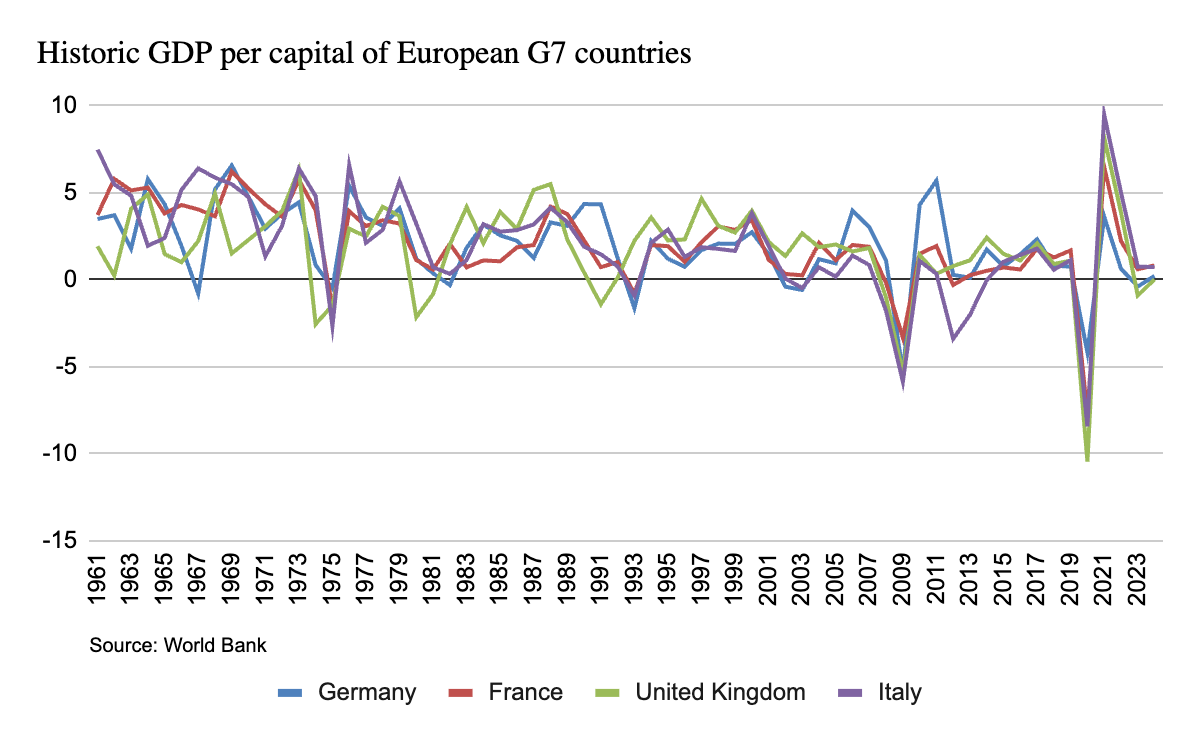

Over the past decade, the United Kingdom has experienced one of its worst periods of economic growth since the 1960s. Growth in GDP per capita significantly declined from pre-2008 trends and sharply declined in 2020 due to Brexit and the pandemic. On the other hand, growth in labor productivity, a key engine of long-term economic growth, has been on the decline from the same inflection point. Although the issues the country is currently facing predate Brexit, the 2016 referendum and subsequent departure from the European Union (EU) further deepened the country’s opportunities for future growth. According to reports by Goldman Sachs, the ongoing economic shortfall the country is facing is primarily attributed to reduced trade, weaker business investment, and labor shortages from reduced immigration from the EU.

Figure 2: United Kingdom Historic GDP and Growth Rates

Figure 3: Historic GDP per capital of European G7 countries

Economic Shocks

Into the discussion 2 cases are analyzed, we concentrate on the macroeconomic effects of Britain’s planning system, as described in the article. We treat planning as the main supply-side constraint for growth, and we build two core scenarios around it.

Scenario 1 – status quo with strict planning rules:

In this scenario, the planning system remains highly discretionary and “veto-friendly.” Large housing and infrastructure projects face long delays and high uncertainty. In macro terms, this is a negative supply-side shock: effective investment in construction and infrastructure is lower, capital accumulation is slower, and potential output stays at a relatively low level.

Scenario 2 – serious planning reform (counterfactual):

Here, we imagine that the government carries out a genuine reform of the planning system, closer to rules-based zoning. Projects that meet clear, predefined criteria are approved automatically, and local veto power is limited. This reduces delays and costs, raises the effective investment rate in housing and infrastructure, and allows more people and firms to locate in high-productivity areas. Although an immediate increase in construction investment can create a short-term shock to demand, leading to a rise, it ultimately contributes to an increase in potential output in the long run.

Strict planning keeps equilibrium output low in Scenario 1, while in Scenario 2, planning reforms increase permanent output to a higher level, which probably leads to economic growth.

A shift towards the planning system

The analysis confirms that the rigidity of the planning system acts as a persistent structural constraint on long-run economic performance. In the analysis, a higher planning strictness lowers the effective investment rate, reduces the steady-state capital stock, and ultimately decreases potential output. A shift towards a more predictable and rules-based planning framework reverses these detrimental effects by raising both short-run activity (through increased construction demand) and long-run output.

From a policy perspective, planning reform represents a comparatively efficient lever for enhancing long-term growth, as it operates through both supply-side improvements and higher capital accumulation. The associated benefits, however, materialize gradually, reflecting the long implementation lags of large investment projects. Short-run pressures may still emerge if the immediate investment response dominates cost-side effects, which underscores the importance of consistent monetary policy during the transition.

Our results both support and challenge the premise around a change in the planning system. We confirm the core diagnosis: that planning rigidity is the fundamental bottleneck to the UK's potential growth.